Annual State of Board Evaluations in the U.S 2025

INTRODUCTION

As in prior years, we collaborated with Gibson, Dunn & Crutcher LLP to analyze the board evaluation disclosures of S&P 500 companies as presented in their proxy statements.[1] This study represents one of the most comprehensive assessments of board evaluation practices in the United States.

Korn Ferry and Gibson Dunn have conducted research of similar scope for the past four years. Where relevant, this report includes year-over-year and three- or four-year comparisons to highlight shifts and developments in board evaluation practices.

New for this year:

- We have analyzed the practices of the World’s Most Admired Companies[2] within the S&P 500 to identify how they differ from the rest of the companies in the index—with some surprising results.

- We have included a survey of board evaluation practices in major markets around the world.

Notable Trends in Board Evaluation Practices – HIGHLIGHTS FROM 2025

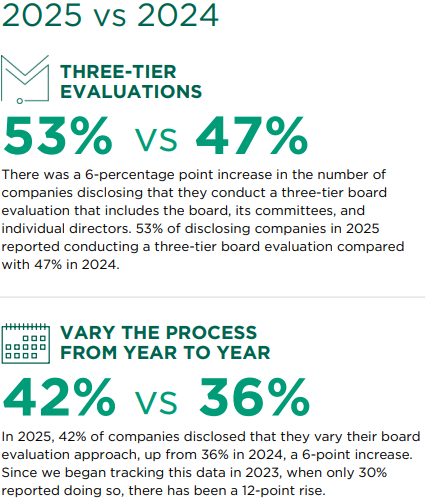

Board evaluation disclosure among S&P 500 companies in 2025 reflected a range of developments. Some practices saw a notable growth in disclosure including three-tier evaluations,[4] varying the process year-to-year, and individual director assessments. In contrast, others, like reporting changes made following evaluations, declined.

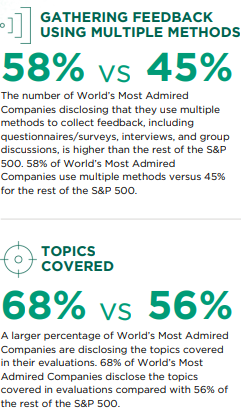

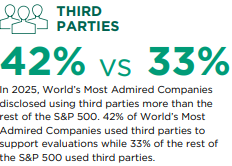

Notably, the World’s Most Admired Companies in the S&P 500 are leading the way in several key areas, including greater transparency around evaluation methodology, broader use of third parties, and more detailed disclosure of evaluation topics.

WORLD’S MOST ADMIRED COMPANIES IN THE S&P 500 VS REST OF THE S&P 500

KORN FERRY COMMENT

Much of the 2025 data reveals a continued shift toward greater transparency and sophistication in board evaluation practices among S&P 500 companies. The increase in three-tier evaluations, greater disclosure around varying evaluation processes year-to-year, the rise in individual director evaluations, and the expanded use of third-party support reflect a governance landscape that is becoming more reflective, adaptive, and performance-focused.

This trend is especially evident among the World’s Most Admired Companies in the S&P 500. The boards of these companies are more likely to disclose detailed information about their evaluation processes, use multiple methods to gather feedback, engage thirdparty facilitators, and share the specific topics covered in their evaluation. However, while boards are increasingly investing in and reporting on the tools and processes used to assess performance, they offer limited insight into how those evaluations translate into action.

Board evaluation practices are only effective when they lead to action; assessment without follow-through does not result in improved governance. Without clear disclosure of post-evaluation outcomes, it becomes difficult for investors to gauge how committed boards truly are to enhancing governance quality.

See the rest of the report here.

1 In preparing this report, Korn Ferry collaborated with attorneys and summer associates from Gibson, Dunn & Crutcher LLP between June and September 2025 to design and conduct the analysis of S&P 500 board evaluation disclosures. (go back)

2 Korn Ferry partners with Fortune to determine the World’s Most Admired Companies ranking.(go back)

3 All percentages in this report represent percentages of the 485 disclosing companies, unless otherwise noted.(go back)

4 A three-tier evaluation assesses the board, the board committees, and individual board members. (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.